With the introduction of advanced technologies and smart banking solutions, the banking and financial system has profoundly transformed. The Internet of Things, Blockchain technology, cryptocurrencies, FinTech, and digital transformation have all played a role in the revolution.

Customers no longer need to visit their branch for services such as opening an account, applying for loans, depositing and withdrawing money, and more. Major financial institutions worldwide now provide Internet and mobile banking services, allowing people to bank whenever and wherever they want. However mobile banking is convenient, but it also increases the chance of fraud, hacks, and other security risks. Thus, it’s essential that mobile banking app developers give safety and security top priority while building their products.

There is a lot to consider when mobile banking application development, from protecting user data to improving usability. All of these steps contribute to the security and reliability of your mobile banking app, from implementing a secure login process with two-factor authentication to encrypting user data and avoiding the storage of personal information on servers.

We may state that mobile banking app development is a challenging task that requires careful consideration of security features and procedures to protect sensitive user data. Another necessity for the app’s design is a seamless and user-friendly experience for users. This blog will examine the most important security measures and best practices for how to create a mobile banking app.

Market Size of the Mobile Banking App

The market for mobile banking is growing quickly due to the rising popularity of smartphones and tablets as well as the development of AI and IoT technologies. Banks and other financial institutions are improving the usability and security of their mobile banking options, which has increased client engagement and loyalty.

The United States, the United Kingdom, Japan, and India are among the developed nations with the largest mobile banking markets. But due to the rising use of mobile banking solutions in emerging nations like Africa and South America, the market is expected to grow rapidly in these regions.

According to research, The Global Mobile Banking Market Research was worth USD 692.5 million in 2021 and is expected to be worth USD 1,359.5 million by 2028. Over the forecast period, the Global Market is expected to grow at a CAGR of 11.9%.

As people become more interested in electronic payments, the market for mobile banking is growing. Digital payments are becoming increasingly popular as consumers desire faster and more secure payment solutions. Through mobile banking solutions, banks have the opportunity to offer customers an easy and secure method to make payments.

The mobile banking business is expected to grow dramatically over the next several years. The industry is expected to grow in the next few years as banks deploy mobile banking solutions at an increasing pace.

The Advantages of Mobile Banking Applications

1. Banking at your Fingertips:

2. One App, Endless Possibilities:

3. Economical and Time-Efficient:

4. Skip the Queues:

5. Personalized Banking Experience:

6. Transparent Financial Data Tracking:

7. Real-Time Fraud Prevention

8. Paying IOUs

9. Smart Investment Opportunities:

How to Create a Banking App

1. Mobile Banking Security Features to Consider -

Authentication:

Data Encryption:

Data Access Controls:

Security of the Network:

2. Steps to Design a Secure Mobile Banking App:

Mobile banking applications are swiftly revolutionizing the banking and financial industries by making it simpler than ever to manage accounts while on the go. Yet, this improvement in convenience also raises the possibility of security risks. There are a few things you should take to guarantee the safety and security of your mobile banking application.

- Finding a reputable mobile banking application development company is the first step in establishing a secure mobile banking application. Search for businesses that have experience in developing a mobile banking application and are aware of the necessary technical and security criteria. Also, confirm that the team developing the banking app is comprised of professionals in software engineering, encryption, and other security standards and that they utilize the most recent technology.

- You must make a thorough plan for the creation of your mobile banking app once you’ve decided on a company to work with. Your app’s features, the project’s scope, the budget, and the completion date should all be included in this plan. It’s crucial to be careful when creating this strategy to ensure that there are no errors or unexpected errors during the development phase.

- The banking app design is the next stage in mobile banking app development. Choose a banking app design that offers the highest level of protection while being simple to use and intuitive to navigate. The user interface should be created with a focus on reducing user error and offering simple, understandable visual signals. To protect sensitive data, the application should also be built using industry-standard encryption techniques and other security safeguards like two-factor authentication.

- Last but not least, you should routinely check your mobile banking app for bugs and security flaws. To simulate real-world usage and test the app against various scenarios, use automated testing tools. Any such flaws should be immediately repaired if they are discovered.

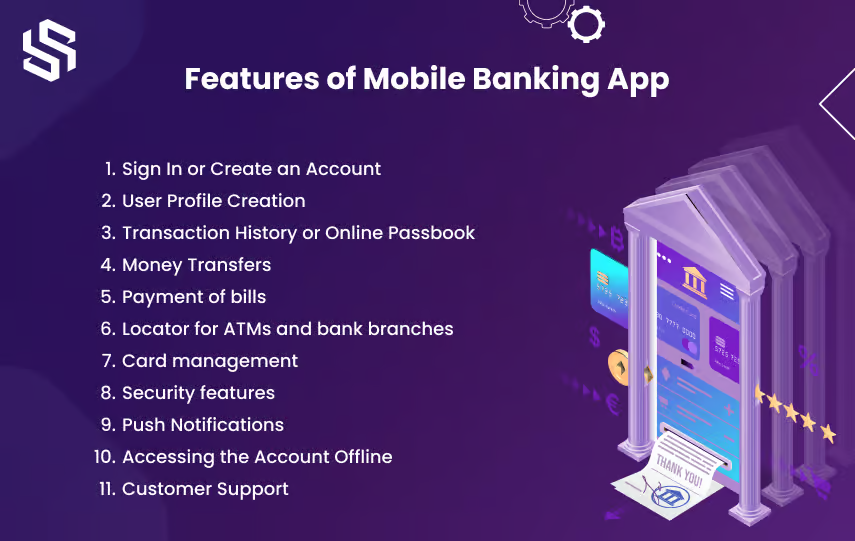

11 Best Features of a Mobile Banking App

The ability to manage finances while on the road has become essential in today’s digitally-driven environment. Customers may now easily access their accounts from any device and at any time, thanks to online banking apps, which have completely changed the banking sector. Mobile banking offers convenience, speed, and security, so it’s no wonder that more and more people are turning to it.

While designing a mobile banking app, it’s crucial to include functionalities that cater to the demands of your users. Customers should benefit from these characteristics in terms of convenience and data security when using the banking system. The following are some essential features that your mobile banking app should have:

1. Sign In or Create an Account:

2. User Profile Creation:

3. Transaction History or Online Passbook:

4. Money Transfers:

5. Payment of Bills:

6. Locator for ATMs and Bank Branches:

7. Card Management:

8. Security Features:

9. Push Notifications:

10. Accessing the Account Offline:

11. Customer Support:

Discover the essential features your mobile banking app needs to succeed.

And let’s build an app that your customers will love to use!

How Much Does it Cost to Build a Digital Bank App?

Mobile banking app development cost depends on a number of factors. The complexity of the app and the features that must be included heavily influence how much it costs to design a banking app. The experience of the development team and the area in which they work are additional cost-influencing considerations.

The price of developing a mobile banking application might differ greatly. Mobile banking app development costs between $40,000 and $60,000 for a basic banking app with just a few functions, like account balance inquiries, money transfers, and transaction histories. Mobile banking app development costs can increase from $100,000 to $200,000 or more, though, if more sophisticated functions like investment tracking, bill paying, and credit score tracking are included.

The platform for which the app is designed might also affect how much the banking app development costs. When compared to hybrid apps, which can be used on both iOS and Android, native apps for each platform require separate development processes, raising the overall cost.

The cost is also significantly influenced by the security elements needed for the banking app. Banking software needs sophisticated security features like encryption, multi-factor authentication, and biometric authentication because it deals with sensitive user data. The price of adding such features might dramatically raise the cost of development.

Finally, the expertise and location of the development team can affect how much it costs to create a banking app. It may be more expensive to hire banking app developers from wealthy nations like the US and Europe than from emerging nations like India and the Philippines.

Top 5 Mobile Banking Applications Examples

1. Chase: Best Mobile Banking App for Prepaid Cards:

2. Bank of America: Best Mobile Banking App for Security:

Known for its top-notch security measures, Bank of America’s mobile banking app provides advanced security features, including biometric authentication and real-time fraud monitoring.

3. Wells Fargo: Best Mobile Banking App for Monitoring Investments:

4. Capital One: Best Online Mobile Banking App:

5. Ally Bank: Best Mobile Banking App for Customer Service:

Conclusion:

The way we access and use financial services has been completely transformed by mobile banking. It has expanded enormously, reaching out to various population segments by offering comfort and simplicity of usage. Quick payments, real-time access, and a variety of other features are all possible with mobile banking.

In conclusion, creating a mobile banking app requires careful planning, robust development, and a focus on security and user experience. To ensure a successful implementation, it is advisable to partner with a reliable software development company that offers mobile app development services. They can guide you through the process, provide expertise in mobile banking app development, and deliver a high-quality product. If you are looking to create a mobile banking app, don’t hesitate to contact us for assistance with your project.

FAQs

The time it takes to create a mobile banking app varies depending on the number of potential features and capabilities, the number of platforms it will support, and the knowledge and availability of the development team. App development typically takes three to six months for smaller apps, while a year or more may be required for more complex ones with more features. Working with a skilled team that can accurately estimate the project’s requirements is essential.

To find the best developer for a mobile banking app, clearly define the project’s scope and requirements, look for experienced developers or development firms, examine portfolios and client reviews, interview candidates, consider budget and timeline constraints, and establish clear expectations. The key to success is selecting a developer who knows the banking sector and developing mobile apps.

The target market and corporate objectives determine whether to develop a banking app for iOS, Android, or both platforms. Building for two platforms is advised if a larger audience and appropriate resources are available. Prioritizing development for a particular platform, however, could be favoured if there are resource constraints or a target audience that uses that platform a lot. Final judgment should be reached after carefully weighing user preferences and corporate requirements.